SAI Weekly #08 - 24: What is Tesla without Elon, Can Scout Win in the U.S., Silicon is the new Battery

- The Sino Auto Insights team

- Feb 23, 2024

- 6 min read

And we are BACK! I couldn’t help myself and posted a non-newsletter newsletter last week even though it was Chinese New Year.

We are seeing flurries of news coming out of the US / EU markets now so keeping up with everything is becoming quite a chore. That said, the influence of China EV / Battery / AV Inc is and for now on, will always be present. This newsletter should be looked at not only as a tool to understand company strategies and interpretation of moves, but should be looked at to help separate fact from fiction.

Coupled with the podcast, they are going to be the best tools for understanding the ever diverse and crazy global mobility sectors. Thanks again for reading and I look forward to any / all of your feedback, questions and constructive feedback.

CHINA EVs & MORE (CEM)

Lei and I are back this week and will have our live show Friday, 9am ET. We plan to talk a bit about HiPhi, the 2024 edition of the China Price War and more. For those that can join, bring any questions or topics you want us to chat about.

If you can can’t join the live show, I invite you to listen to our recorded China EVs & More episodes at this site. And as always, we appreciate any feedback that will make the show better.

TESLA

- If Tesla loses its investors, it loses its leverage and its status as an AI / technology company will disappear. Tesla will still have an advantage on manufacturing and scale for quite some time but without the tech cred that Elon gives them, what is Tesla really?

With the recent rhetoric from Elon, the sales panic in China and the ROW, Tesla is starting to feel some heat and look less invincible than they did just 15-18 months ago.

Don’t pay too much attention to growth in Europe for now, it’s the US and China that really set the table and allow Tesla to do what they want to do without caring about what journalists write because it means that the investors are still on board. Having the #1 vehicle in Europe is just a bonus for Elon.

This WSJ article lays out a lot but not all of what’s in front of Tesla, challenges, opportunities, etc. But it doesn’t lay out that if they’re able to launch the M2, specifically in the China market by mid-2025, all may be forgiven and they could sell a bunch of them which would solidly help them get back on track. But are there too many distractions for Elon or can his team execute. The Tesla one I mean…

INTERVIEWED / QUOTED

- Automotive World. A discussion with Stewart Burnett about the chances of a Stellantis / Renault merger and the benefits and risks should it happen. “It would be malpractice if [Renault’s Chief Executive] Luca de Meo and Tavares weren’t talking to organisations about ways to save costs and make the whole stronger.”

It’s a UK publication so forgive the misspellings. (Haha)

NO WORDS NEEDED

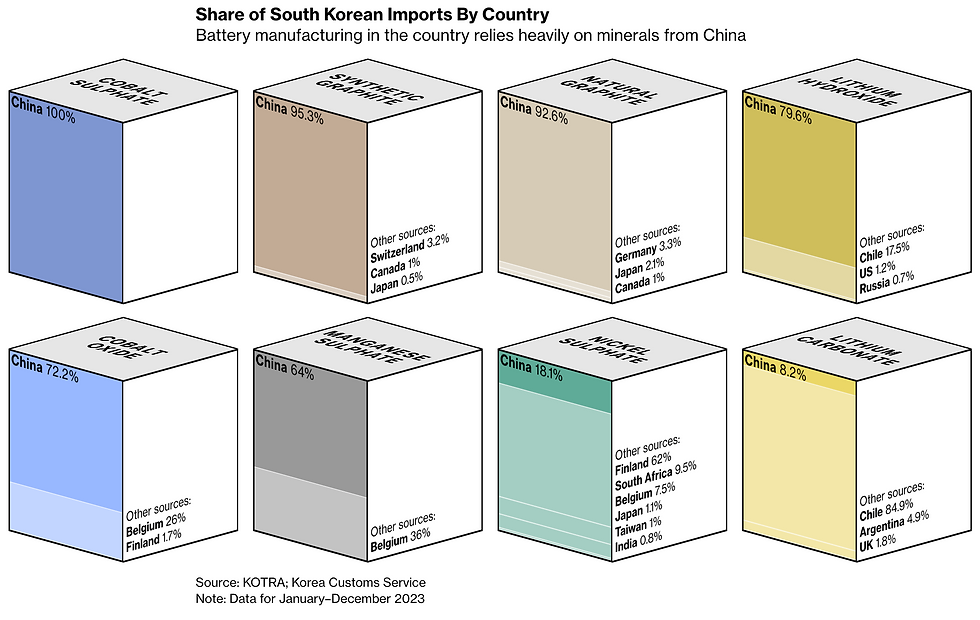

Chart courtesy of Bloomberg

BIGGEST NEWS OF THE WEEK

- Will 2024 be the year that BYD overtakes Tesla in BEV sales? If you recall, the score in 2023 was Tesla – 1,808,581 vs. BYD – 1,574,822 with the caveat being that BYD outsold Tesla in Q4 526,409 vs. 484,507. My guess is that it won’t be this year but maybe 2025.

- As Brian Gu and team mentioned at the IAA Munich last year, XPeng was going to aggressively enter more foreign markets in 2024. It’s revised ‘Go Abroad 2.0’ strategy has them entering Jordan, Lebanon, the UAE and Egypt markets while expanding their product portfolios in Germany, the UK, Italy and France. Curious to see how the G6 and the G9 outside its domestic borders, but it’ll depend largely on how aggressively they price it too.

- On or about the 1 year anniversary of their last layoff, Rivian decides to cut 10% of its staff again. There are 16K total employees but that includes factory workers so the cut could be as high as 1.6K people but likely a bit less. Nonetheless, death by 1K cuts isn’t great for morale. Rivian needs to finally get things right or RJ needs to get got.

- Can Scout go where VW hasn’t? While China has dedicated NEV brands like NIO, XPeng, Li Auto, BYD, Aito, Fang Cheng Bao, Jiyue, Lotus, Zeekr, GAC Aion, Yangwang, Neta, LeapMotor, Avatr, Seres, Voyah, Shenlan, Geometry, Wuling, Polestar just to name a few off the top of my head, the US has Rivian (more on that one later), Lucid and Tesla.

That’s to say we need more EV brands in the U.S. to create more competition for the legacy automakers. Tesla is doing a fine job on its own, but if we’re to get past 8% take rate we need a few more brands that bring sizzle and good products. Unfortunately, that time has likely passed, not many VCs want to pour money into any new EV brands when it’ll likely take >$5B to get to Job #1.

In comes Scout. It’s a new brand that’s not really. If you are >60 years old that is. But it’s backed by VW Group. VW brand has 4% share in the U.S. but have much different luck in the EU. China was historically, but is now a market that threatens to take down the whole ship (Group that is).

Can Scout succeed where VW fails in the U.S.? My gut tells me no, but I’ll need more details on the product strategy before I can make any real assessment. This post is really just a call for ambitious founders to launch new EV brands. Use Foxconn to build them for you, it’ll slash costs and if you have a great product, its Blue Ocean in the U.S. still baby!

THE BEST ARTICLE I READ THIS WEEK

- Bloomberg did its homework and should be applauded. I am certain it took the team of journos quite some time to sort out all the details and get the interactive graphics right for the article but this is certainly one of the best articles that captures how screwed we (the US) and the EU are through 2030 (at least) with regards to rare earth mining and refining. What’s also good about this article is the role that the Japanese and Korean companies will play in trying to take out China from their supply chains in order to receive IRA money.

I won’t spoil it too much since it’s worth the click, especially since I am putting my stamp on it as worthy of your 5-7 minutes.

BY THE NUMBERS

- $1.5B. That’s how much in grant money the US govt (read: we Americans) was awarded to Global Foundries to expand their fabs in New York and Vermont. That’s only the beginning as there’s about $51.5B left to dole out from the CHIPs Act. Silicon is the new Battery.

As of right now, my moles tell me that none of the grants / funding is likely to go to any projects in Michigan. A missed opportunity for us.

- 13.03M. That’s how many BEVs, PHEVs and FCEVs were sold globally in 2023. That’s a YoY growth of ~30% which was lower than in 2022 when the YoY growth was 54.2%. Consultancy Trendforce sees sales growth to stay close to 30% in 2024.

- 58%! That’s the percentage of U.S. drivers that interacted with their phones as they drove in 2022. More than 33% of those trips were at speeds over 50 MPH. Since there is no definitive way currently to connect distracted driving to fatalities, the 3.5K fatalities from distracted driving in 2021 is likely much larger.

This creates the most compelling case for ADAS because these numbers won’t get better unless there are really new laws and ways to enforce them. If you’re wondering, U.S. drivers are worse at distracted driving than their UK and a number of European companies.

This is all according to a report by Cambridge Mobile Telematics who work with insurance companies that use their app to determine car insurance rates so they would know, they have the data.

_________________

This weekly newsletter is a collection of articles we feel best reflect the happenings of the week or important trends that have effects on the global automotive and mobility sectors. We also provide a point of view that we hope educates and sparks debate.

The Sino Auto Insights team

I've explored numerous options before, but overall, the quality of these erotic services is in a league of its own. The level of attention they pay to detail and their unwavering focus on truly satisfying the client is completely unparalleled. Greater Noida Escorts || Escorts in Karol Bagh || Mahipalpur Escorts Service || Dwarka Call Girls || Call Girls in Saket ||

Bangalore Escorts || Bangalore Escorts Service || Bangalore Female Escorts || Bangalore Independent Escorts || Escorts Service in Bangalore || Bangalore Call Girls || Call Girls in Bangalore || Bangalore Russian Escorts || Escorts in Bangalore || Shavaji Nagar Escorts || RT Nagar Escorts || Whitefield Escorts || Yelahanka Escorts || Yeshwanthpur Escorts || Jayanagar Escorts || Malleswaram Escorts || Mahadevapura Escorts || Marathahalli Escorts || Rajaji Nagar Escorts || HSR Layout Escorts || Hebbal Escorts || Jalahalli Escorts || Domlur Escorts || Electronic City Escorts || Ulsoor Escorts || Bellandur Escorts || Indira Nagar Escorts || Jp Nagar Escorts || Vijay Nagar Escorts || Koramangala Escorts || Mg Road Escorts Bangalore || Jaipur Escorts || Agra Escorts || Ahmedabad Escorts || Ajmer Escorts || Aurangbad Escorts || Bhubaneswar Escorts || Chandigarh Escorts || Chennai Escorts || Daman Escorts || Delhi Escorts || Gawalior Escorts || Ghaziabad Escorts || Gurgaon Escorts || Haldwani Escorts || Haridwar Escorts || Hyderabad Escorts || Independent Bangalore Escorts || Indore Escorts || Jabalpur Escorts || Jamshedpur Escorts || Jodhpur Escorts || Kanpur Escorts || Kochi Escorts || Kolkata Escorts || Lucknow Escorts || Ludhiana Escorts || Mumbai Escorts || Mysore Escorts || Nagpur Escorts || Nainital Escorts || Nashik Escorts || Noida Escorts || Patna Escorts || Pune Escorts || Raipur Escorts || Rajkot Escorts || Rishikesh Escorts || Shimla Escorts || Shirdi Escorts || Surat Escorts || Trivandrum Escorts || Udaipur Escorts || Vadodara Escorts || Varanasi Escorts || Vijayawada Escorts

Bangalore Russian Escorts It just indicates that you are interested in forming an adult friendship with attractive Bangalore Female Escorts if you are here. We are pleased to inform you that you have succeeded in your search for a beautiful, stylish, captivating, and attractive Bangalore Call Girls . We are among Bangalore Escorts Service providing top-notch outrageousness via adult female models every second. All we ask is that you have a taste of Bangalore Escorts sexual offerings. When you have a sexual need, give yourself energy for the more enjoyable or pleasant feeling.

Thanks for Your article...it gives us immense knowledge. This is a titanic mixing article. I am all around that genuinely matters content with your

Bangalore call girl

Lucknow call girl

You can try several postures, such as the Spooning or Spider poses. Adding sensual massages to your repertoire can improve intimacy and satisfaction. Your body will crave pleasure as a result of our Escorts in Vinod Nagar' skillful application of sexual massage techniques. They know how to create the perfect atmosphere for a memorable experience, from enticing touches to calming strokes.